—— Two thirds of the country thinks the U.S. is on the wrong track. The number is going up among Republicans (no surprise), Independents (not good for Democrats) and even Democrats (uh-oh).

—— Public opinion on who should fund college education is undergoing a big shift toward government funding. In accordance with that, the U.S. Department of Education has canceled student loan debt for 40,000 people and offered credits to help another 3.6 million pay off their loans.

—— What happens if the health care premium tax credits in the American Rescue Plan are allowed to expire? Bad things, man. Some states may take local action to help, but if they don’t, a report from the Urban Institute says that

3.1 million more people will be uninsured.

Individuals and families enrolled in the Marketplaces or other nongroup coverage will pay hundreds of dollars more per person each year in premiums.

The non-Hispanic Black population, young adults, and people with incomes between 138 and 400 percent of the Federal poverty level will experience the largest coverage losses.

There will be a cost to keeping the credits in place: the report estimates doing so will will increase the federal deficit by $305 billion over 10 years.

—— U.S. mortgage interest rates reached a 12 year high in April. The consumer response was a decline in the demand for housing.

—— Producer prices for final demand items were up 11.2 percent in March, the largest increase since the time series began in 2010.

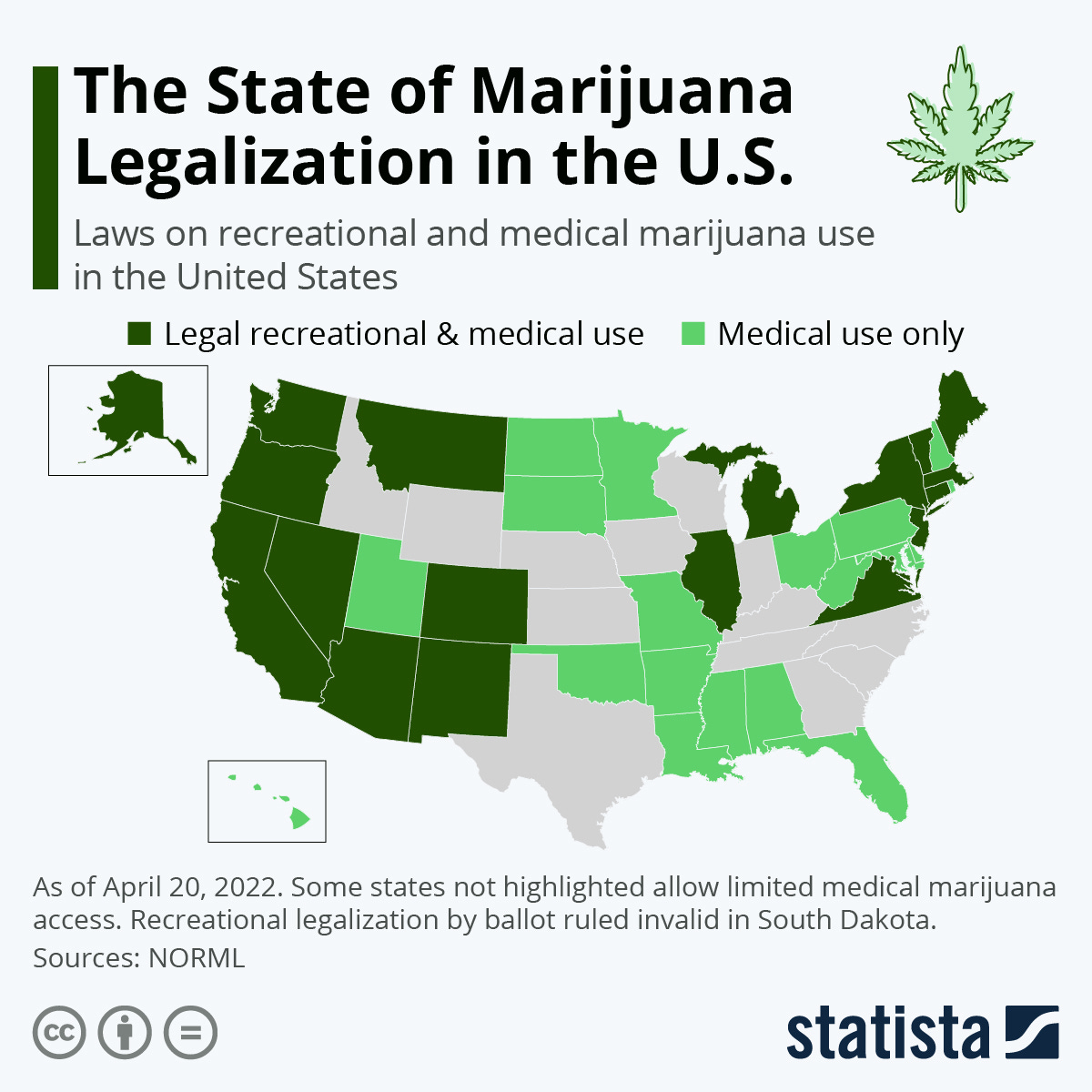

—— From Statista, the state of marijuana legalization in the U.S.

—— Again from Statista, the chart below says to me that, even after the economic disruption associated with the pandemic, support for environmental protection still outweighs support for economic growth.

—— Inflation ate up the earnings increase for retail workers in March. On the basis of a 0.4 percent increase in earnings and and 1.2 percent increase in the Consumer Price Index, real hourly earnings dropped 0.8 percent from February to March. During the past 12 months real average hourly earnings for retail workers fell 2.7 percent.

That’s it for today. Until later, take care.

Karl Pearson